Bonus tax calculator 2021

Bonus included in salary. With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396 percent.

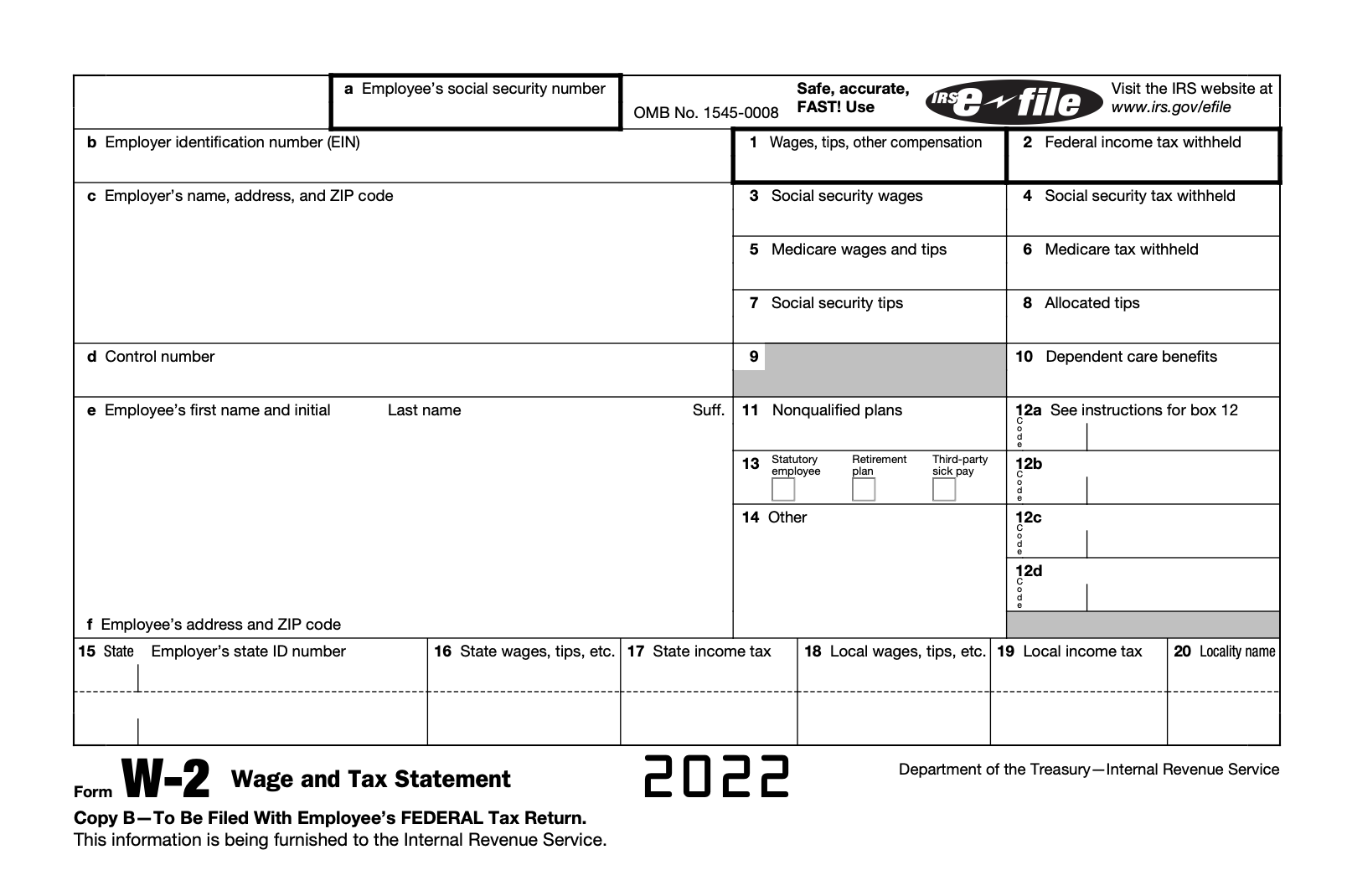

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Calculate how tax changes will affect your pocket.

. A tax calculator for the 2021 tax year including salary bonus travel allowance pension and annuity for different periods and age groups. Bonus Pay Calculator Tool. FREE INCOME TAX CALCULATOR BY.

Also understand how bonuses are taxed differently than regular wages and about withholding methods. In 2021 you will pay FICA taxes on the first 142800 you earn. This calculator uses the Aggregate Method.

This is known as the Social Security wage base limit. If your state doesnt have a special supplemental rate see our aggregate bonus calculator. Give it a go.

If you have other deductions such as student loans you can set those by using the more options button. The calculator assumes the bonus is a one-off amount within the tax year you select. Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year.

Travel allowance included in salary. Add as a plugin or widget to any website. The Viventium Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay. R534083 - R518083 R160 than the annualisation method does meaning that Thandis tax being withheld is closer to her eventual tax liability.

Calculate withholding on special wage payments such as bonuses. Your bonus and any other supplemental wages you receive are subject to Social Security Medicare and FUTA. YourTax Terms and conditions.

Generally most employers chose to use the percentage method. Its so easy to use. Employers typically use either of two methods for calculating federal tax withholding on your bonus.

After subtracting these amounts if the total remuneration for the year including the bonus or increase is 5000 or less deduct 15 tax 10 in Quebec from the bonus or retroactive pay increase. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. Rather than using a flat tax rate the bonus is added to regular wages to determine the additional taxes due.

Thandis total tax for March 2020 will then be. Calculates income tax monthly net salary bonus and lots more. Under tax reform the federal tax rate for withholding on a bonus was lowered to 22 down from the federal income tax rate of 25.

The aggregate method or the percentage method. The Ohio bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

Free South African income tax calculator for 20212022. R258083 R260000. Learn how bonuses are taxed as taxable income in 2021 and 2022.

The current Social Security tax rate is 62 percent for employees. All you need to do is enter your regular salary details and then enter the amount of the bonus. Youll notice this method gives a lower tax amount ie.

Discover Helpful Information And Resources On Taxes From AARP. Usual tax tax on bonus amount. After subtracting the above amounts if the total remuneration for the year including the bonus or increase is more than 5000 the amount you.

These two methods are used to calculate federal income tax. You will need to. Sage Income Tax Calculator.

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Llc Tax Calculator Definitive Small Business Tax Estimator

Bonus Calculator Percentage Method Primepay

What Is The Bonus Tax Rate For 2022 Hourly Inc

How Bonuses Are Taxed Calculator The Turbotax Blog

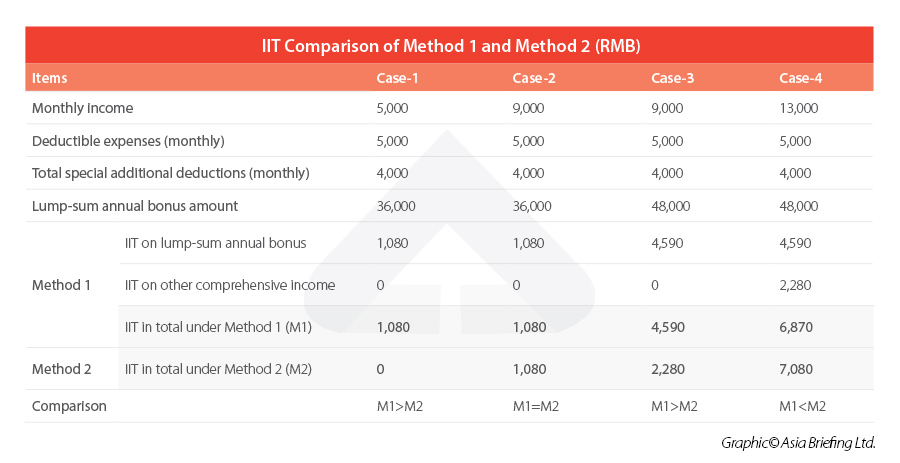

China Annual One Off Bonus What Is The Income Tax Policy Change

How Bonuses Are Taxed Calculator The Turbotax Blog

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

China Annual One Off Bonus What Is The Income Tax Policy Change

Bonus Tax Rate In 2021 How Bonuses Are Taxed Wtop News

Avanti Bonus Calculator

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

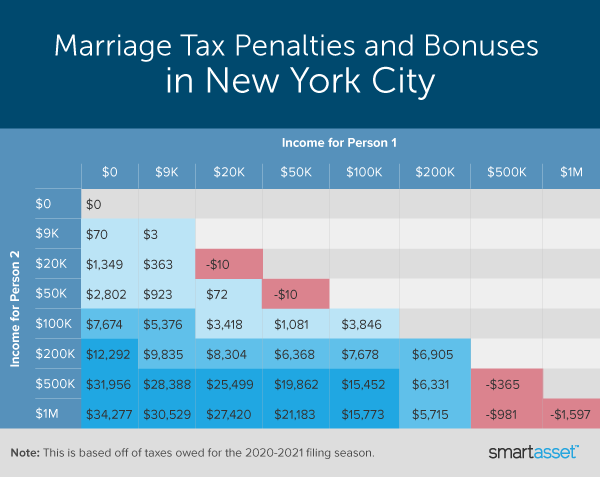

Marriage Penalty Vs Marriage Bonus How Taxes Work

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

What Are Marriage Penalties And Bonuses Tax Policy Center

Flat Bonus Pay Calculator Flat Tax Rates Onpay

How To Calculate Bonuses For Employees